No more bubbles

Roger Wiegand said it best in his most recent article "Inflation moves into Overdrive". Here is his assessment of the current state of play.

"Nothing is going to stabilize the housing markets. The only thing left for our money controllers is to mitigate the speed of the consumer’s housing, debt, and net worth crash. It is going to be a slow motion smasheroo and nothing can stop it. It can be slowed or temporarily stopped with tricky public relations and fallacious government reports and numbers but the conclusion is set in stone. There are no more bubbles for consumers to blow. The die is cast and we can only wait for the ending to arrive."

We have only just begun....

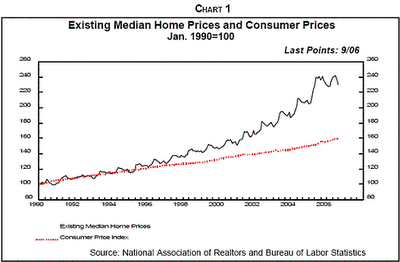

1. House prices have outpaced inflation.

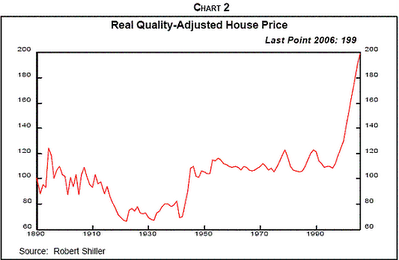

2. Even adjusting for quality, prices are way out of line relative to historical averages.

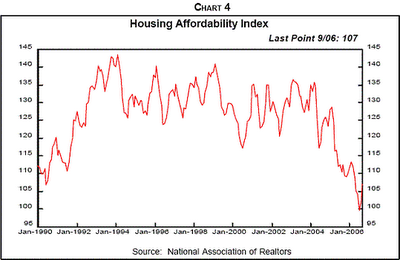

2. Even adjusting for quality, prices are way out of line relative to historical averages. 3. Despite the recent limited fall in prices, houses are still far too expensive.

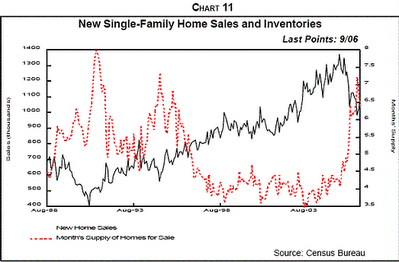

3. Despite the recent limited fall in prices, houses are still far too expensive. 4. New home sales have fallen, but they have a long way to go before they return to the levels seen before the bubble. Inventory is running at 7 months of sales and rising.

4. New home sales have fallen, but they have a long way to go before they return to the levels seen before the bubble. Inventory is running at 7 months of sales and rising. Things are going to get a lot worse, before they get better

Things are going to get a lot worse, before they get better

Financing in Houston

It was the title of this video clip that grabbed my attention - " the financial environment right to buy a condo in Houston". The answer wasn't too clear, it had something to do with "five percents", "ten percents" and end users.

Can anyone translate?

Housing Horror

The most recent Federal Reserve's Flow of Funds Accounts reads like a horror story. Some of the most recent statistical trends are so perverse that they stretch credibility. Take these recent developments

The Fed isn’t the only institution reporting frightening statistics. Freddie Mac reports that 90 percent of its refinanced loans resulted in new balances at least 5 percent higher than the previous loan.. The median age of a refinanced loan was 3.4 years. Refinancing continues despite falling house prices and rising rates. In the third quarter of 2006, the median ratio of new-to-old interest rates was 1.12.

This means that half of those borrowers who paid off their original loan and took out a new one increased their mortgage coupon rate by 12%, or roughly three-eighths of a percentage point at today's level of fixed mortgage rates. This is the highest ratio since Freddie Mac began compiling this information in 1985.

It can only end badly.

Foreclosures in the rise - big surprise there.

Here are Top 10 States with Homes in Foreclosure October 2006:

1. Colorado 1 out of 337 homes (117 % increase)

2. Nevada 1 out of 389 homes (557 % increase)

3. Georgia 1 out of 449 homes (99 % increase)

4. Michigan 1 out of 623 homes (88 % increase)

5. Illinois 1 out of 632 homes (144 % increase)

6. Florida 1 out of 640 homes (49 % increase)

7. Ohio 1 out of 654 homes (55 % increase)

8. Tennessee 1 out of 668 homes ( 99 % increase)

9. New Jersey 1 out of 675 homes (37 % decrease)

10. Utah 1 out of 718 homes (13 % increase)

The data is curtesy of Realtytrac

Flipper Nation

Oh happy days, flipping houses for $75 bucks. Now, flippers are lucky if they escape bankruptcy.

Orlando

Houston market

Great video looking at overpriced isolated housing developments in Houston. It is all rather disturbing.

A bad moon is rising, I see trouble is on its way.

US housing starts at a six year low

At the same time, the number of permits awarded for future housing projects fell to its lowest level since 1997.

Where housings starts go, construction jobs follow. Welcome to the construction recession.

No, No, No.......

Here is a cracking video looking at the housing bubble in the UK. In contrast to the US, house prices in the UK are still rising. The higher they go, the further they have to fall....

Great depression versus today's housing crash

Every man is the the master of his silence and a slave to his word.

Here are some choice quotes from people who should know better.

Krugman on the housing market

It is a grim message from one of America's most respected economists. House prices are coming down, and unemployment is going up.